Life Insurance in and around Louisville

State Farm can help insure you and your loved ones

Now is the right time to think about life insurance

Would you like to create a personalized life quote?

- Springhurst, KY

- Shelbyville, KY

- Shelby County, KY

- Louisville, KY

- St. Matthews, KY

- Prospect, KY

- Mt. Washington, KY

- Oldham County, KY

- Kentucky, US

- Bullet County, KY

- Henry County, KY

- Spencer County, KY

- Jeffersontown KY

- Middletown, KY

- Eastwood, KY

Your Life Insurance Search Is Over

People purchase life insurance for many different reasons, but the primary reason is normally the same: to protect the financial future for your family after you perish.

State Farm can help insure you and your loved ones

Now is the right time to think about life insurance

Agent Terrence Bailey, At Your Service

Personalized service is what sets State Farm apart from the rest. And it won’t stop once your policy is signed. If tragedy strikes, Terrence Bailey is waiting to help process the death benefit with care and consideration. State Farm has you and your loved ones covered.

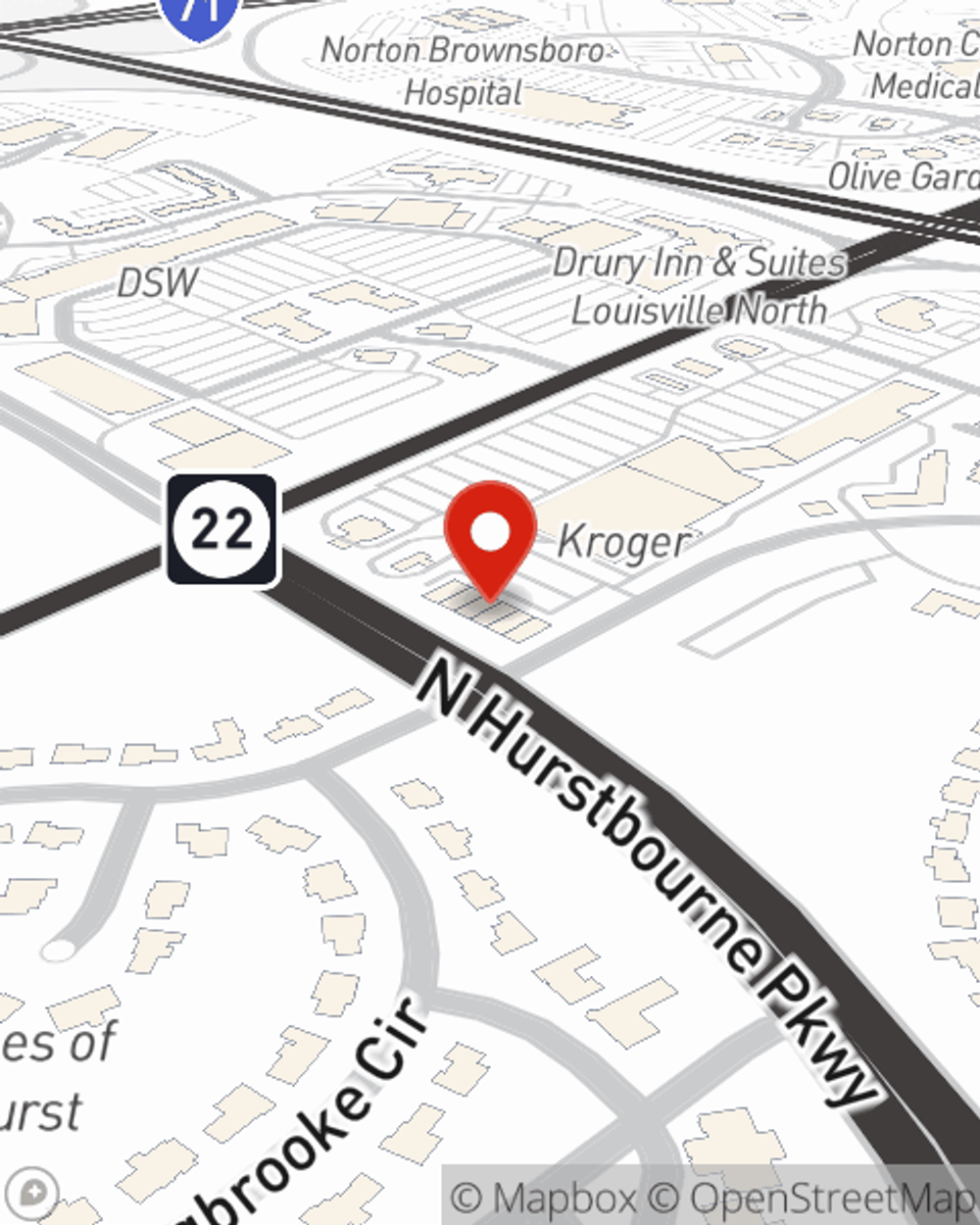

Visit State Farm Agent Terrence Bailey today to find out how the leading provider of life insurance can care for those you love most here in Louisville, KY.

Have More Questions About Life Insurance?

Call Terrence at (502) 339-1517 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Is life insurance worth it?

Is life insurance worth it?

When deciding if life insurance is worth buying, start by looking at what's important to you and how you want to protect it.

Term life insurance vs. Whole life insurance: Which is right for you?

Term life insurance vs. Whole life insurance: Which is right for you?

Understanding the basics, benefits and realities of both term life insurance and whole life insurance is important in deciding which is right for you.

Terrence Bailey

State Farm® Insurance AgentSimple Insights®

Is life insurance worth it?

Is life insurance worth it?

When deciding if life insurance is worth buying, start by looking at what's important to you and how you want to protect it.

Term life insurance vs. Whole life insurance: Which is right for you?

Term life insurance vs. Whole life insurance: Which is right for you?

Understanding the basics, benefits and realities of both term life insurance and whole life insurance is important in deciding which is right for you.